If you’re a first time buyer, you might feel that the whole process of buying your first home and applying for a mortgage is a little daunting.

At Mortgage Advice Hub, we completely understand.

We’ll look after you and guide you through the whole process, explaining all your options in clear, easy-to-understand language.

You’ll want to make sure you get the right deal too, so we will discuss your personal circumstances with you, such as income, outgoings, future plans and savings. This means, that when we are searching the market, including offers and deals not normally available on the high street, we can get the best deal for a first-time buyer, even if you have poor credit history.

We make buying your first home, a simple, stress-free process you can feel confident in. With your friendly, knowledgeable expert with you every step of the way, it’s just a few straightforward stages, and can be only a matter of weeks, until you have the keys to your first home in your hand:

-

Find out how much you can borrow by using our easy Mortgage Tools, or talking to us

-

Find a home you can afford. View it and, if you like it, make an offer

-

If your offer is accepted, your mortgage lender will survey your property

-

Your solicitor will get started on the legal work of you buying your house – we can help you get in touch with a solicitor if you don’t have one

-

Your solicitor will make sure contracts are exchanged and your purchase completes

-

Your mortgage completes

-

You pick up the keys and move in!

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances. The fee is up to 1%, but a typical fee is 0.3% of the amount borrowed.

Where do you go from here?

You can make an appointment to talk to one of our friendly mortgage experts, either in person or on the phone, at a time to suit you.

You can contact us now on 0300 303 0913 and speak to one of our team right away.

You can fill out our quick enquiry form to request a callback.

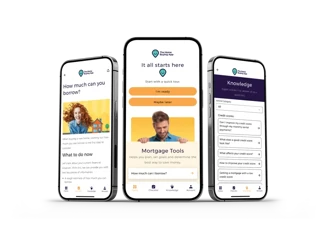

The Home Buying App

Our app helps you to work towards the goal of getting your own home

Use our savings trackers, step-by step checklists, and lots of useful guides.