Getting a mortgage with bad credit

If a bad credit history is holding you back from getting on the property ladder, it can feel as if you’re never going to get that new home you dream of. But the good news is, that many people with bad credit history are able to get a mortgage. It’s not impossible; it’s just harder than if you had a perfect credit history.

What is a remortgage?

Now could be the perfect time to start thinking about a remortgage. Whether you’re looking to renovate your home and need to find some money to fund the renovations, or simply want to save some money on your monthly repayments, remortgaging could help you do this.

First time buyer advice: Our 9 top tips

Buying your first home is exciting – however it can feel daunting too. But the good news is we’re here to help guide you every step of the way. So if you’re looking for first time buyer advice, this article offers our top tips.

Guide to green mortgages

What are green mortgages and could you save money by taking one out? We explain everything you need to know about green mortgages in this article, from how they work, what the benefits are and how to find out if you’re eligible to get one.

As a homeowner what insurance do I need?

If you’re buying your first home you’re probably asking what insurance do I need? There are lots of different types of insurance available so you might find the choice a bit overwhelming. So that’s why we’ve put this article together to talk you through everything you need to know about protection. That way you'll know how to get the right cover for your needs.

How to remortgage: The preparation you need to know

With the cost of living crisis and soaring inflation, we’re all trying to save on our outgoings so you may want to find out how to remortgage. That’s because you might be able to save on your monthly mortgage payments by remortgaging onto a better deal. Also, with the recent increases in interest rates, now may be a good time to lock in a new mortgage. But how do you prepare for your remortgage? We explain what you need to know with these remortgaging tips.

Buying a buy to let property

When buying a buy to let you’re investing a lot of money so read our top tips on everything from the style of property you buy to the type of tenants you’re hoping to attract before taking the plunge.

Should I remortgage now?

With the current cost of living, sky high inflation and rising interest rates, you may be wondering if now is this right to remortgage your home and could it save you money?

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances. The fee is up to 1%, but a typical fee is 0.3% of the amount borrowed.

Where do you go from here?

You can make an appointment to talk to one of our friendly mortgage experts, either in person or on the phone, at a time to suit you.

You can contact us now on 0300 303 0913 and speak to one of our team right away.

You can fill out our quick enquiry form to request a callback.

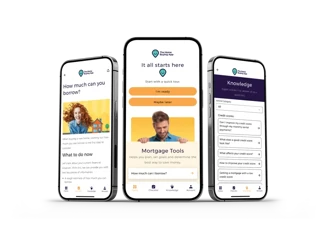

The Home Buying App

Our app helps you to work towards the goal of getting your own home

Use our savings trackers, step-by step checklists, and lots of useful guides.